Stages Of Foreclosure Offer Financial Relief To Homeowners

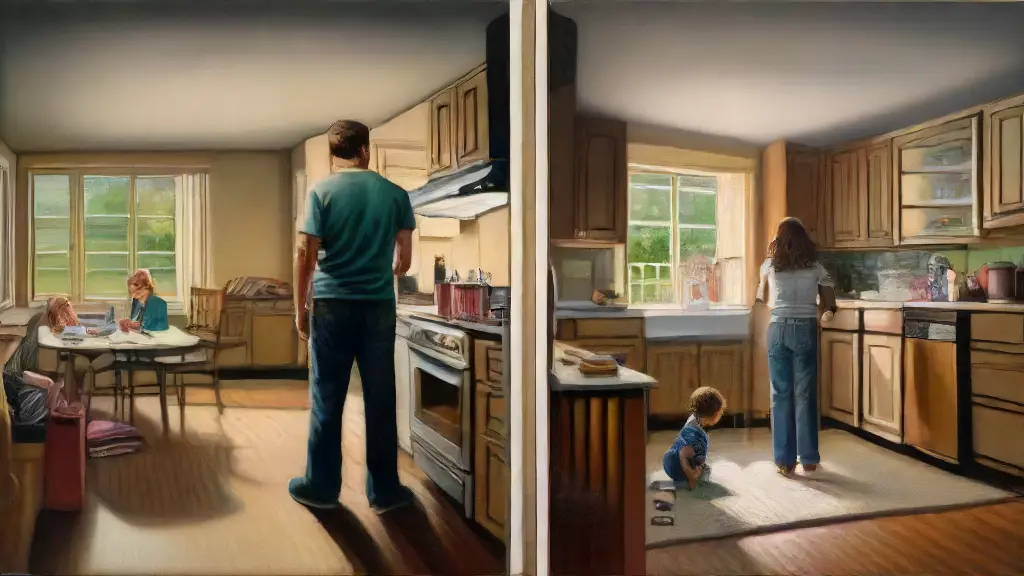

The journey to homeownership can be fraught with challenges, but when unforeseen financial hurdles arise, many individuals find themselves at a crossroads. In such situations, the path to foreclosure may seem inevitable, but understanding the stages involved can bring solace and, indeed, financial relief.

The foreclosure process typically begins with a delinquency, which occurs when mortgage payments are 90 days past due.

During this stage, homeowners can proactively seek mortgage assistance programs to rectify their financial difficulties.

If the delinquency is not addressed, the lender may initiate foreclosure proceedings. At this point, homeowners have a limited window to take control of their financial situation and explore foreclosure alternatives, such as seeking financial recovery. If homeowners are struggling with their mortgage payments, there are various programs available to provide mortgage assistance, financial recovery, foreclosure alternatives, short sale benefits, deed-in-lieu, and mortgage relief.

Click here to learn more about: mortgageadvisorleads.com

Understanding Foreclosure Alternatives

When financial pressures mount, the key to regaining control lies in uncovering a path forward, one that preserves property rights and stabilizes economic security.

Requires a thoughtful assessment of one’s current financial situation. This involves taking a closer look at indicators of financial distress, reviewing loan terms and contracts, and creating a realistic budget to calculate monthly expenses.

Home retention strategies can serve as a lifeline for debtors, offering a reprieve from the threat of foreclosure.

This includes negotiating with lenders to reshape payment plans, potentially saving homeowners thousands of dollars in missed payments.

Lender mediation is often the first step in finding a solution, allowing homeowners to communicate with their lenders and explore options such as principal reductions or rehabilitation programs to reduce their debt burden. The company specializes in providing comprehensive financial solutions, including home retention, credit restoration, lender mediation, workout options, loss mitigation, and property preservation.

Financial Hardship And Mortgage Relief

When unforeseen setbacks strike, the ripple effect on family finances can be devastating, leaving some homeowners scrambling to keep up with their mortgage payments.

Early warning signs of financial hardship include a sudden drop in income, unexpected expenses, or a combination of both, which can lead to mortgage delinquency. A delinquent mortgage can have severe consequences, including a negative impact on credit scores and the potential for foreclosure.

A Notice of Default is typically served after a homeowner has missed several mortgage payments, signaling the start of the foreclosure process.

This is a critical stage in which homeowners must take immediate action to prevent the loss of their property.

Fortunately, debt forgiveness options are available for some homeowners, while others may need to negotiate with creditors to secure a better mortgage settlement. In some cases, financial restructuring can provide temporary relief, thereby allowing individuals to reorganize their debt and secure a more sustainable financial future.

Facts About Mortgage Delinquency and Foreclosure

- A sudden drop in income or unexpected expenses can lead to mortgage delinquency, which can negatively impact credit scores and result in foreclosure.

- A delinquent mortgage can have severe consequences, including a negative impact on credit scores, and the potential for foreclosure, which can be prevented by taking immediate action.

- Financial restructuring can provide temporary relief by allowing individuals to reorganize their debt and secure a more sustainable financial future.

- A Notice of Default is typically served after a homeowner has missed several mortgage payments, signaling the start of the foreclosure process, and immediate action is required to prevent loss of property.

What Is Deedinlieu Of Mortgage

In today’s fast-paced world, homeowners face various financial challenges that can put a significant strain on their ability to make mortgage payments on time. When this happens, a crucial decision must be made, as the consequences of defaulting on a mortgage can be severe.

One foreclosure intervention strategy that can provide relief is a deed-in-lieu of foreclosure, a process that allows borrowers to transfer ownership of their property back to the lender.

This type of mortgage rescue can offer a viable solution for homeowners who are unable to continue making payments.

Understanding the process is crucial, as it can be complex and involve multiple stakeholders. A deed-in-lieu of foreclosure is a legal agreement between the borrower and lender, where the borrower surrenders the property to the lender in exchange for cancellation of the mortgage debt. This agreement requires careful consideration, as it will impact the homeowner’s financial future and potential to take advantage of foreclosure intervention, credit repair, debt consolidation, mortgage rescue, and homeowner advocacy solutions.

Can Lender Mediation Save Your Home

The fragile balance of homeownership is threatened by the specter of foreclosure, leaving many wondering if there’s a way to stave off financial ruin and salvage their most valuable asset.

According to the National Homeownership Strategy, over 1 million foreclosure filings were recorded in 2020, leaving a trail of financial devastation in its wake.

Lender mediation has emerged as a beacon of hope for these individuals, offering a chance to restructure payments and avoid the harsh consequences of foreclosure.

Understanding the foreclosure process is crucial in determining the effectiveness of lender mediation.

It begins with an initial delinquency, followed by a notice of default, and ultimately, a foreclosure auction and sale. The consequences of foreclosure are far-reaching, including damage to credit scores and financial reputation. Lender workouts can provide a lifeline for struggling homeowners, facilitating communication and negotiation between borrowers and lenders to create a sustainable debt management plan that balances financial planning with homeowner rights and access to mortgage assistance programs.

| Number of Foreclosure Filings | Consequences of Foreclosure | Lender Workouts |

|---|---|---|

| Over 1 million (2020) | Damage to credit scores and financial reputation | Facilitates communication and negotiation between borrowers and lenders |

| Includes harsh consequences such as foreclosure auction and sale | Creates a sustainable debt management plan | |

| Access to mortgage assistance programs |

Benefits Of Short Sale Process

Homeowners facing financial distress often feel overwhelmed by the prospect of losing their property, but a well-executed short sale can be a lifeline, providing a chance to reboot and regain control.

When it comes to navigating a difficult financial situation, many homeowners are unaware of the benefits of the short sale process.

Property valuation plays a crucial role in determining the success of a short sale, as it helps to establish a fair market value for the property, leading to a smoother debt settlement process.

A short sale can also provide a valuable opportunity for mortgage restructure, allowing homeowners to rework their mortgage terms and avoid additional financial burden, ultimately achieving financial freedom.

By choosing a short sale over foreclosure, homeowners can significantly reduce their debt settlement costs and take a major step towards improving their credit score. One of the most significant advantages of a short property valuation is that it provides a clear picture of your current financial situation, allowing for easier mortgage restructure, debt settlement, attainment of financial freedom, improvement of your credit score, and potential mortgage refinancing.

Is Property Preservation Important

Property preservation.

In today’s market, it’s more important than ever to recognize the significance of property preservation.

When homes are left abandoned, it’s not only the property that suffers but also the surrounding community.

Neglected properties can lead to a decline in property values, increased crime rates, and decreased neighborhood appeal, ultimately affecting the quality of life for local residents.

Failing to maintain a property can result in severe debt reduction difficulties for homeowners, including reduced mortgage workout plan options and lender negotiation prospects. Without a stable property portfolio, debt reduction strategies can unravel, leaving homeowners vulnerable to reduced home equity protection and financial stability uncertainties. For loan holders and lenders, the consequences of abandoned properties are even more far-reaching, including the potential loss of home equity protection, debt reduction, financial stability, and the need for lender negotiation and mortgage workout plans, ultimately leading to property disposition.

Property Preservation Facts

- A single abandoned property can decrease surrounding property values by up to 10%.

- According to the National Association of Realtors, 75% of homeowners say that property maintenance is crucial for maintaining property values.

- Properties left abandoned for more than 6 months can experience a 50% decrease in value.

- Lenders can foreclose on properties that are not properly maintained, leading to financial instability for homeowners.

How Does Credit Restoration Work

The path to financial wellness often begins with a thorough examination of one’s credit report. Here, a tangled web of inaccurate accounts, missed payments, and unflattering credit utilization ratios can weigh heavily on an individual’s financial future.

Creditors may not be as keen to forgive debts, but credit restoration can breathe new life into financial recovery services by disputing inaccurate reports and negotiating with creditors to achieve better repayment terms.

According to the Federal Trade Commission (FTC), credit restoration companies must clearly outline their services and the potential benefits.

It’s essential to choose a reputable provider, as some services may promise unrealistic results. In addition to debt elimination, a comprehensive plan may also include mortgage relief services.

A critical component of credit restoration is credit report analysis. By examining the report, credit counselors can identify errors and work with clients to rectify these issues, ultimately helping individuals to achieve financial recovery through their financial wellness services provided.

What Are Mortgage Refinancing Options

The burden of mortgage debt can be crushing for many homeowners, with the risk of delinquency resolution looming large over their heads. According to the Federal Reserve, over 4% of mortgages are currently delinquent, highlighting the pressing need for effective mortgage assistance options.

One common misconception is that refinancing a mortgage is a straightforward process.

It requires careful consideration of various factors, including credit score optimization and foreclosure prevention services.

A mortgage professional can help borrowers navigate the complex landscape and identify the most suitable refinancing option.

Rate Reduction Refinancing is a popular choice for homeowners seeking to lower their monthly payments.

By refinancing to a lower interest rate, borrowers can enjoy significant savings over the life of the loan, thus reducing their mortgage modification programs expenses. Some lenders offer foreclosure prevention services to help struggling homeowners avoid loan workout strategies and instead provide mortgage modification programs, delinquency resolution, credit score optimization, and mortgage assistance options.

| Mortgage Delinquency Rate | Refinancing Options | Foreclosure Prevention Services |

|---|---|---|

| Over 4% | Rate Reduction Refinancing, Mortgage Modification Programs | Loan Workout Strategies, Credit Score Optimization |

Preventing Foreclosure Saves Homes And Families Financially

What Is Foreclosure And How Can It Benefit You